The Swedish Tax Agency has checked Jocke and Jonna AB's tax return for 2019 with comments on certain deductions, which results in at least SEK 363 000 in extra tax.

The difference in some cases is subtle between what an influencer uses privately and what concerns business activities.

For example, the deduction for the couple's trip to Crete was rejected. The trip was described by the company as a trip to find fabrics and other materials before the launch of Jonna's new children's clothing brand.

However, the Swedish Tax Agency assessed the trip as a private holiday trip as no receipts and other verifications to prove the business trip had been submitted. In addition, the trip seemed to be sponsored by a company.

Nor could costs for Jocke and Jonna AB's expensive luxury cars be deducted as the Swedish Tax Agency considered that they had been used privately.

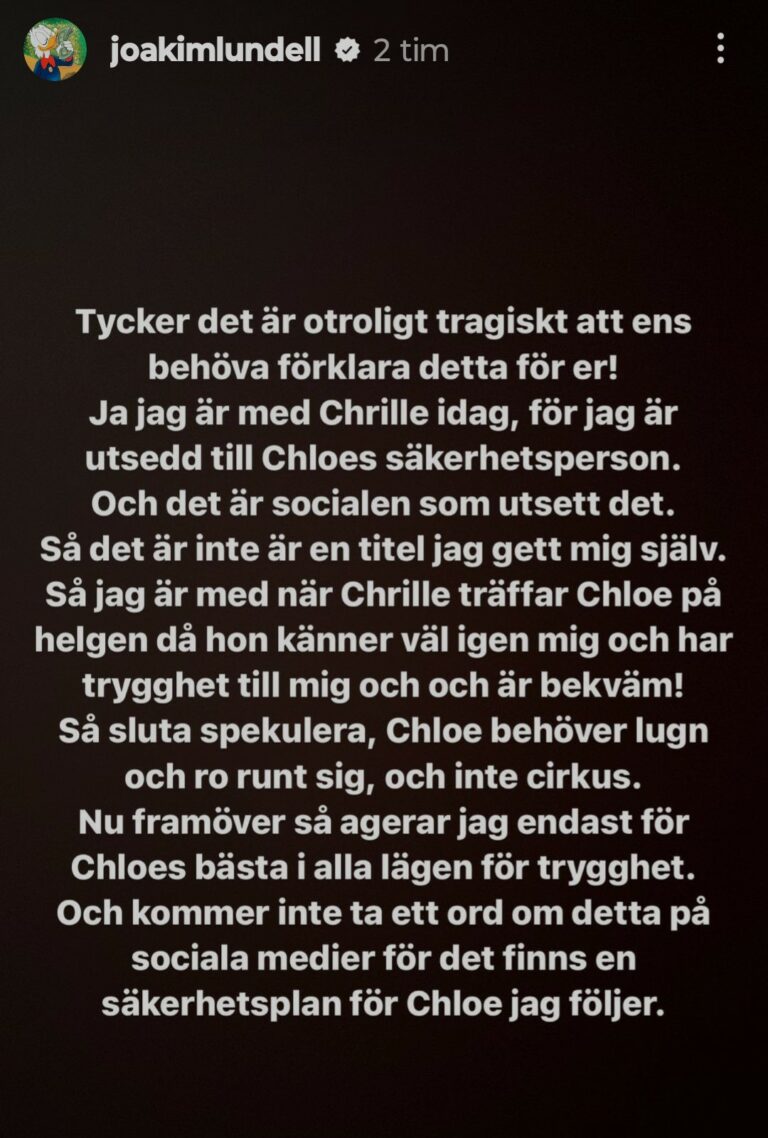

Expressen, which is writing about this has had an email conversation with Joakim Lundell and he answers in his email as follows:

"I think we who work in the attention economy, which is largely a film-based entertainment and marketing industry, must become even better at showing the authorities how our industry works."

"In that work, I want to be transparent and welcome a good dialogue with the Swedish Tax Agency on issues such as this."

Screenshot: instagram/joakimlundell/montage